The fintech industry is one of the fastest-growing and most competitive sectors globally. With technology transforming banking, financial services, and insurance (BFSI), fintech companies are creating innovative solutions like mobile payments, fraud detection systems, and blockchain technologies.

However, launching these solutions successfully requires a go to market (GTM) strategy. A GTM strategy ensures fintech companies address challenges such as regulatory compliance, trust-building, and competitive differentiation while reaching their target customers effectively.

In this guide, we provide a detailed, step-by-step approach to developing a strong go to market strategy for fintech.

What is fintech?

Fintech, short for “financial technology,” refers to the use of technology to innovate and improve financial services. Fintech solutions aim to make processes faster, safer, and more accessible for individuals and businesses.

Fintech includes:

- Digital Payments: Mobile wallets, peer-to-peer payments, and payment processors.

- Lending and Credit: Online lending platforms and credit scoring systems.

- Insurtech: Technology-driven solutions for the insurance industry.

- Blockchain and Cryptocurrencies: Secure, decentralized financial transactions.

- WealthTech: Tools for investment management, robo-advisors, and analytics.

Think about this: when was the last time you paid for coffee with cash? Chances are, you pulled out your smartphone or a card, tapped on a machine, and completed the transaction within seconds. That’s fintech in action—making our lives faster, simpler, and more convenient. Whether it’s splitting bills with friends using a peer-to-peer app, receiving instant approval for a loan, or checking investments through a robo-advisor, fintech is seamlessly integrated into our everyday routines. It’s no longer just an industry—it’s a lifestyle.

However, launching these solutions successfully requires a go to market (GTM) strategy. A GTM strategy ensures fintech companies address challenges such as regulatory compliance, trust-building, and competitive differentiation while reaching their target customers effectively.

When does a fintech company need a go to market strategy?

A go to market strategy is important at several stages of a fintech company’s lifecycle. Here’s when you need it:

1. Product launch

If you’re introducing a new fintech solution—like a mobile payment app or fraud detection software—a GTM strategy ensures you:

- Identify the right customers (e.g., individuals, small businesses, or enterprises).

- Highlight your product’s unique value and solve real problems.

- Launch effectively while ensuring compliance with regulations.

2. Expanding into new markets

Fintech companies expanding into new geographical regions face challenges like differing regulations, cultural preferences, and competitive landscapes. A GTM strategy helps:

- Adapt the product to meet local regulations and customer needs.

- Create targeted marketing campaigns to drive adoption.

- Build trust with customers unfamiliar with your brand.

3. Scaling and diversification

If you’re scaling your existing fintech solution or adding new features, a GTM strategy helps maintain momentum. It ensures you:

- Retain existing customers while attracting new segments.

- Refine messaging for new offerings.

- Use the right channels to scale efficiently.

4. Securing partnerships

Partnerships with banks, insurers, or tech providers are vital for fintech growth. A GTM strategy outlines how to approach potential partners, build credibility, and create value.

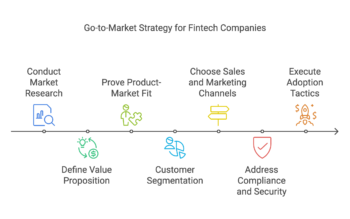

7 Steps to develop a go to market strategy for fintech companies

1. Conduct market research

Market research is the foundation of any successful go to market (GTM) strategy. For fintech companies, this process involves deeply understanding the market, customers, and competition.

- Identify your customers: Determine whether your target audience includes banks, financial institutions, or end-users such as consumers and small businesses. Each audience type has unique needs and expectations.

- Understand customer pain points: Investigate specific problems your audience faces, such as:

- Security concerns related to digital transactions.

- High transaction fees that burden users.

- Slow payment processing systems that affect business operations.

- Analyze the competition: Study existing fintech solutions in the market. Look at their pricing models, customer satisfaction levels, and unique selling points to identify gaps or areas where your product can excel.

For fintech products targeting the Banking, Financial Services, and Insurance (BFSI) sectors, regulatory compliance plays a significant role. Research the regulatory landscape in your target markets to ensure your solution adheres to the necessary laws.

2. Define your value proposition

A clear value proposition that resonates is important to show why customers need your product over competitors. This statement must highlight both the problem your solution addresses and the measurable benefits it offers.

- Focus on solving key customer pain points:

- For example, is your product addressing issues like payment delays, inefficient workflows, or the lack of advanced fraud detection mechanisms?

- Highlight benefits: Emphasize specific outcomes your customers can expect, such as:

- Faster transaction processing times.

- Cost savings compared to existing solutions.

- Enhanced security features to prevent fraud.

Your value proposition should be simple, outcome-driven, and tailored to resonate with your target audience.

3. Prove product-market fit

Product-market fit ensures that your product meets a genuine market demand and solves a problem for customers effectively. To achieve this:

- Launch a minimum viable product (MVP): Introduce a basic version of your product to gather real-world user feedback.

- Run pilot programs: Collaborate with early adopters like small banks, businesses, or fintech-forward consumers to test your solution on a smaller scale.

- Measure key metrics: Track adoption rates, customer satisfaction scores, and return on investment (ROI) to determine product success and identify areas for improvement.

4. Customer segmentation

Fintech companies often serve a diverse audience with varying needs. Proper customer segmentation ensures that you focus resources on the most promising groups and tailor your messaging effectively.

- Segment by customer type:

- B2B (Business-to-Business): Financial institutions, insurance companies, and payment service providers.

- B2C (Business-to-Consumer): Individual consumers looking for solutions like digital wallets, savings tools, or personal loans.

- Hybrid: Some fintech solutions, such as cross-border payments or payment platforms, serve both businesses and consumers.

- Further Segmentation: Divide your audience by:

- Geographical regions: Understanding regional preferences and regulatory requirements.

- Company size: Differentiating strategies for small businesses versus large financial enterprises.

- Behavioral patterns: Tailor outreach based on how users interact with existing solutions or their adoption readiness.

Well-defined customer segmentation helps focus marketing efforts, improve lead targeting, and increase conversion rates.

5. Choose your sales and marketing channels

Selecting the right sales and marketing channels is crucial for ensuring that your fintech solution reaches the intended audience and generates engagement.

- Direct sales: Ideal for complex B2B solutions, where strong relationships and trust-building with decision-makers in financial institutions are essential.

- Strategic partnerships: Collaborate with banks, insurance providers, or other BFSI entities to expand your reach and credibility. Partnerships can also help integrate your product with existing systems.

- Digital marketing: Implement online strategies such as:

- Search Engine Optimization (SEO): Improve search visibility to attract inbound leads.

- Pay-Per-Click (PPC) Advertising: Use targeted ads to generate interest from specific customer segments.

- Content Marketing: Create valuable content, such as blogs and whitepapers, to showcase thought leadership and educate customers about your solution.

- Referral programs: Encourage organic growth by offering incentives to existing customers for referring your product to others.

For fintech solutions targeting BFSI markets, organizations like Aexus often prioritize partnership-building to accelerate adoption and credibility.

6. Address compliance and security

Fintech companies operate in highly regulated industries, making compliance and security integral to any GTM strategy. Failure to meet standards can result in penalties, lost trust, or product rejection.

- Identify key regulations: Research and comply with critical regulations in your target markets, such as:

- PSD2 (Payment Services Directive 2) in Europe.

- GDPR (General Data Protection Regulation) for data privacy.

- AML (Anti-Money Laundering) standards.

- Embed security features: Build trust by integrating essential security tools into your product, including:

- Advanced fraud detection systems.

- Data encryption to safeguard transactions and sensitive information.

- Compliance features for local and international regulations.

- Collaborate with legal experts: Work with compliance advisors to ensure your product can seamlessly adapt to regulatory requirements across multiple markets.

Addressing compliance early not only builds trust with customers but also reduces legal risks during expansion.

7. Execute adoption tactics

The launch phase must focus on driving rapid product adoption and generating momentum. Effective tactics include:

- Pilot programs: Partner with trusted institutions, such as early-adopter banks or businesses, to demonstrate real-world use cases and outcomes.

- Create onboarding materials: Simplify adoption with clear educational resources such as:

- Webinars and live demos to walk users through product features.

- Tutorials and user guides to ensure a smooth learning curve.

- Other tactics:

- Limited-time offers to incentivize early adopters.

- Free trials or freemium models that allow users to experience the value before making a commitment.

These adoption tactics ensure users quickly realize the benefits of your fintech solution, increasing retention and creating advocates for your product.

A successful go to market strategy for fintech combines research, clear value propositions, and trust-building initiatives. Whether launching a new product, scaling an existing solution, or expanding into new markets, a GTM strategy provides the framework needed to succeed.

Contact form

Frequently Asked Questions (FAQs)

1. Why is a GTM strategy critical for fintech companies?

A GTM strategy ensures that fintech companies launch products successfully by addressing unique challenges such as regulatory compliance, security concerns, and customer trust. It provides a roadmap to identify target customers, select the right channels, and drive adoption.

2. How do fintech companies ensure regulatory compliance in their GTM strategy?

Fintech companies must research local and global financial regulations, such as PSD2 in Europe and GDPR for data security. Partnering with legal advisors and integrating compliance features (like encryption and fraud detection) ensures smooth market entry.

3. What are common mistakes fintech companies make during product launches?

Some common mistakes include:

- Ignoring regulatory requirements in new markets.

- Overlooking customer needs or feedback during product development.

- Failing to build trust through clear communication about security and value.

4. What role do partnerships play in a fintech GTM strategy?

Partnerships are critical for growth. Collaborating with banks, insurers, or payment providers allows fintech companies to access existing customer bases, improve credibility, and expand faster into new markets.

Interested in more go to market strategies? We’ve created a gtm guide for startups as well!